Current price and net asset value

Past yields

Past performances don’t guarantee future performances. In addition to examining the retrospective yields, it is also essential to observe the recommended minimum investment horizon.

Infó

Total net asset value of the different investment fund series (data calculated using the compound interest method with a fractional exponent on a 365-day annual basis). Values before deduction of taxes, contributions and distribution costs. The sources of past performances: Bloomberg (benchmark) and OTP Alapkezelő (funds).

Buy your investment unit in OTP InternetBank!

You can also buy your investment unit online if you have internet bank access and a securities account at OTP Bank.

DetailsPresentation of the fund

This is a fund investing in foreign exchange bonds of emerging market, European, Middle Eastern and African countries.

For whom and for how long investment horizon is it recommended?

The fund is recommended for those looking for a well-diversified investment opportunity consisting of government securities, mortgage bonds and other bonds, predominantly issued in non-domestic currencies, with high maturity yields.

The recommended minimum investment horizon is 3 years.

Benchmark

- 80% ICE BofA BBB&Lower EMEA Sovereign EUR External Debt

- 20% ZMAX

Objective of the fund

The aim of the fund is to provide a flexible, anytime available, HUF-based investment option for longer-term funds in foreign currency bonds of emerging European, Middle Eastern and African countries (EMEA region).

Investment policy

The Fund’s assets are mainly well-rated emerging market bonds with a regional focus on EMEA, whose bankruptcy and interest

rate risks are considered moderate.

The exchange rate risk arising from the purchase of foreign currency bonds may not necessarily be covered by the fund manager.

However, where the fund manager deems it appropriate, it may completely eliminate the foreign exchange risk arising from instruments

denominated in foreign currencies by way of forward currency sales, but it may also undertake open foreign currency positions

at its discretion.

Portfolio managers

Awards and recognition

The fund won the Privatbankar.hu Junior Klasszis Award for the Most Promising Free Bond Fund of the Year in 2015. In 2025, Privatbankar.hu awarded it the Klasszis Award for the best free bond fund of the year.

Where can you buy investment units?

At OTP Bank

The investment units of the fund are available online or in the branches.

Via OTP InternetBank or OTP MobilBank

You can also buy investment units online if you have internet bank access and a securities account with OTP Bank.

Buy onlineIn person at an OTP Bank branch

Find your nearest securities trading bank branch and make an appointment!

Book on appointmentInformation on distribution

There is no limit on the value of an investment in the fund. You can buy investment units in any amount and increase or decrease the value of your investment as you wish. Moreover, the nominal value of the fund is HUF 1, so you can easily, flexibly and accurately adjust the value of your investment to the amount you want to invest.

What distribution fees should I expect?Please consult the various distributors’ announcements for more detailed information on the subscription and redemption commission charged by the distributors in relation to the distribution of the fund units and on any other fees and commissions arising in relation to the investment fund (securities account management fee, the transfer fee of fund units, etc.).

How does settlement take place?This is an open-ended fund, so its units can be bought and redeemed on any trading day at the net asset value (price) per unit on that day. For the distribution of the units of the fund T+3 days settlement will be used, i.e. the settlement and the crediting of the units will take place on the 3rd trading day (T+3 days) following the order at the price calculated on the basis of the closing price at the end of the trading day (T+1 day) following the order.

Fund performance

This section provides information on the Fund's past performance.

Infó

The Fund's past performance is no guarantee of future returns. When making an investment decision, it is essential to consider not only historical returns but also the recommended minimum investment period.

Performance for closed calendar years

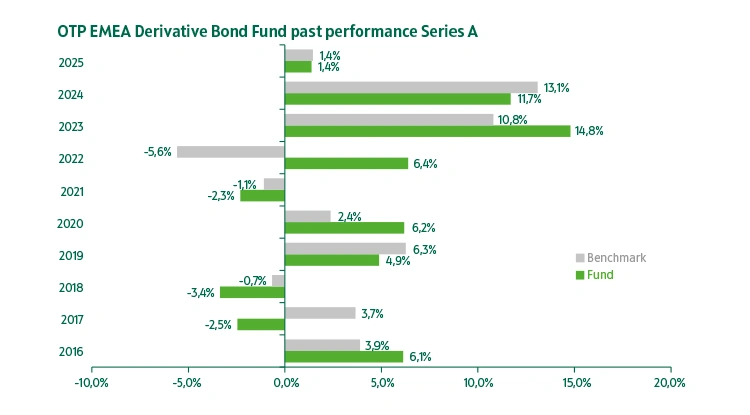

Past performance of Series A investment unitsThe chart shows the Fund's performance since inception, but for a maximum of the last 10 years, as a percentage of losses or gains relative to the benchmark. Past performance is not a reliable indicator of future performance. Markets may perform very differently in the future. The chart can help you assess how the Fund has been managed in the past and compare it to its benchmark.

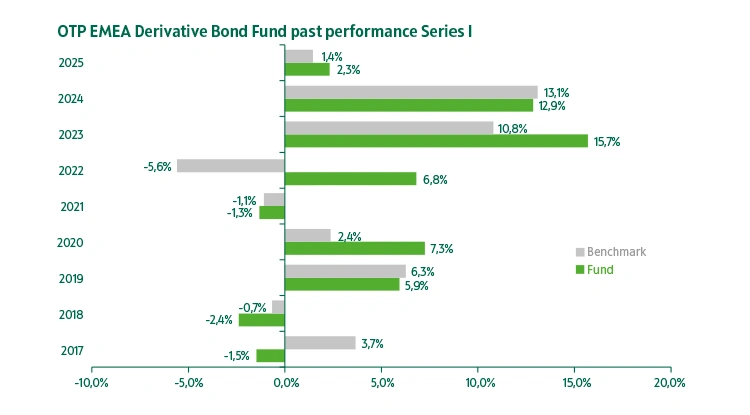

Past performance of Series I investment unitsThe chart shows the Fund's performance since inception, but for a maximum of the last 10 years, as a percentage of losses or gains relative to the benchmark. Past performance is not a reliable indicator of future performance. Markets may perform very differently in the future. The chart can help you assess how the Fund has been managed in the past and compare it to its benchmark.

Past performances

Net returns based on net asset value, expressed as a percentage, annualized returns for periods longer than 1 year (calculated

using the compound interest method, based on a 365-day year). Values before deduction of taxes, contributions and distribution

costs. Source of historical yield data: Bloomberg (reference index) and OTP Fund Management (funds).

Risk indicators

In this section, you will find past performances of the main risk indicators for the fund. The volatility, tracking error,

alfa, maximum drawdown are expressed in percentage.

Past performance of Series I investment units

Past performance of Series I investment units