Current price and net asset value

Past yields

Past performances don’t guarantee future performances. In addition to examining the retrospective yields, it is also essential to observe the recommended minimum investment horizon.

Infó

Total net asset value of the different investment fund series (data calculated using the compound interest method with a fractional exponent on a 365-day annual basis). Values before deduction of taxes, contributions and distribution costs. The sources of past performances: Bloomberg (benchmark) and OTP Alapkezelő (funds).

Buy your investment unit in OTP InternetBank!

You can also buy your investment unit online if you have internet bank access and a securities account at OTP Bank.

DetailsPresentation of the fund

This is a fund offering high equity exposure based on individual stock selection without regional constraints.

For whom and for how long investment horizon is it recommended?

The fund is recommended for longer-term financial goals and portfolio building for all those who expect their investment returns to be driven by rising global equity markets.

The recommended minimum investment horizon is 5 years.

Benchmark

- 30% CETOP

- 25% MSCI EMU Net Total Return

- 25% MSCI Emerging Net Total Return USD

- 10% MSCI World Net Total Return USD

- 10% RMAX

Objective of the fund

Over the long term, the fund seeks to achieve a level of return significantly exceeding the performance of government securities by providing high equity exposure. As a result of the persistently high equity exposure, the fund is expected to move along with global equity markets, while attempting to outperform passive stock price indices with an active, value-oriented investment policy.

Investment policy

The fund’s assets are invested predominantly (at least 80%) in equities, with typically 2-5% of the fund’s assets invested in each equity. In addition to equities, the portfolio may include liquid assets and derivatives to help the efficient construction of the portfolio and to hedge currency risks.

The fund follows a value-based investment strategy, with the portfolio elements selected by the managers based primarily on fundamental analysis with a view to long-term returns. With exposure to multiple regions, a more flexible basket of shares can be built up to better adapt to circumstances.

Portfolio managers

Awards and recognition

In 2018, the fund was awarded the Privatbankar.hu Klasszis Award.

Where can you buy investment units?

At OTP Bank

The investment units of the fund are available online or in the branches.

Via OTP InternetBank or OTP MobilBank

You can also buy investment units online if you have internet bank access and a securities account with OTP Bank.

Buy onlineIn person at an OTP Bank branch

Find your nearest securities trading bank branch and make an appointment!

Book on appointmentInformation on distribution

There is no limit on the value of an investment in the fund. You can buy investment units in any amount and increase or decrease the value of your investment as you wish. Moreover, the nominal value of the fund is HUF 1 or EUR 1, so you can easily, flexibly and accurately adjust the value of your investment to the amount you want to invest.

What distribution fees should I expect?Please consult the various distributors’ announcements for more detailed information on the subscription and redemption commission charged by the distributors in relation to the distribution of the fund units and on any other fees and commissions arising in relation to the investment fund (securities account management fee, the transfer fee of fund units, etc.).

How does settlement take place?This is an open-ended fund, so its units can be bought and redeemed on any trading day at the net asset value (price) per unit on that day. For the distribution of the units of the fund T+3 days settlement will be used, i.e. the settlement and the crediting of the units will take place on the 3rd trading day (T+3 days) following the order at the price calculated on the basis of the closing price at the end of the trading day (T+1 day) following the order.

Fund performance

This section provides information on the Fund's past performance.

Infó

The Fund's past performance is no guarantee of future returns. When making an investment decision, it is essential to consider not only historical returns but also the recommended minimum investment period.

Performance for closed calendar years

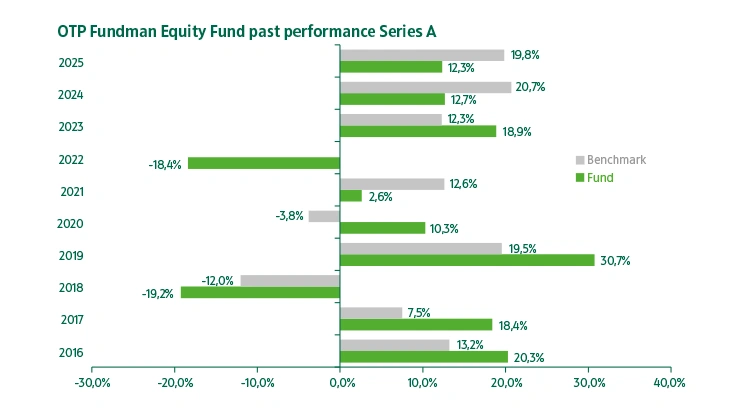

Past performance of Series A investment unitsThe chart shows the Fund's performance since inception, but for a maximum of the last 10 years, as a percentage of losses or gains relative to the benchmark. Past performance is not a reliable indicator of future performance. Markets may perform very differently in the future. The chart can help you assess how the Fund has been managed in the past and compare it to its benchmark.

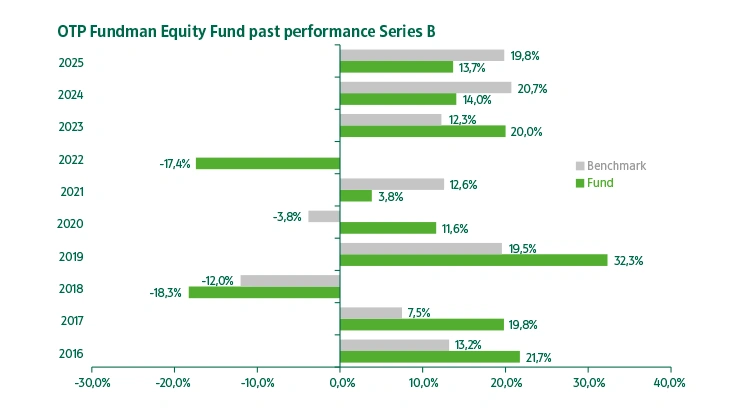

Past performance of Series B investment unitsThe chart shows the Fund's performance since inception, but for a maximum of the last 10 years, as a percentage of losses or gains relative to the benchmark. Past performance is not a reliable indicator of future performance. Markets may perform very differently in the future. The chart can help you assess how the Fund has been managed in the past and compare it to its benchmark.

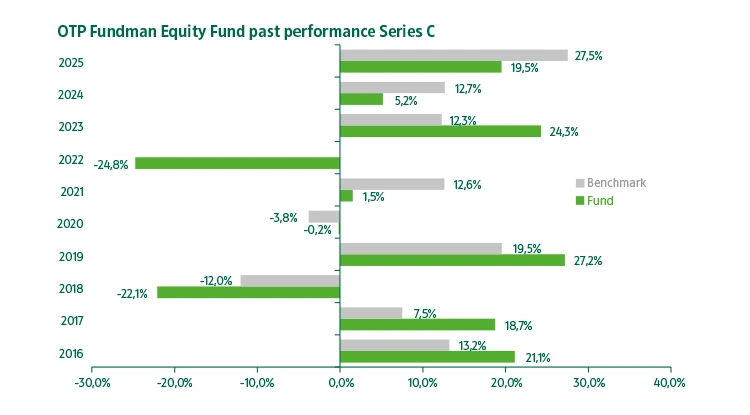

Past performance of Series C investment unitsThe chart shows the Fund's performance since inception, but for a maximum of the last 10 years, as a percentage of losses or gains relative to the benchmark. Past performance is not a reliable indicator of future performance. Markets may perform very differently in the future. The chart can help you assess how the Fund has been managed in the past and compare it to its benchmark.

Past performances

Net returns based on net asset value, expressed as a percentage, annualized returns for periods longer than 1 year (calculated

using the compound interest method, based on a 365-day year). Values before deduction of taxes, contributions and distribution

costs. Source of historical yield data: Bloomberg (reference index) and OTP Fund Management (funds).

Risk indicators

In this section, you will find past performances of the main risk indicators for the fund. The volatility, tracking error,

alfa, maximum drawdown are expressed in percentage.

Past performance of Series B investment units

Past performance of Series B investment units

Past performance of Series C investment units

Past performance of Series C investment units