Current price and net asset value

Past yields

Past performances don’t guarantee future performances. In addition to examining the retrospective yields, it is also essential to observe the recommended minimum investment horizon.

Infó

Total net asset value of the different investment fund series (data calculated using the compound interest method with a fractional exponent on a 365-day annual basis). Values before deduction of taxes, contributions and distribution costs. The sources of past performances: Bloomberg (benchmark) and OTP Alapkezelő (funds).

Buy your investment unit in OTP InternetBank!

You can also buy your investment unit online if you have internet bank access and a securities account at OTP Bank.

DetailsPresentation of the fund

The fund contains shares in companies active in the exploitation of renewable resources and in the green industry related to sustainable development.

For whom and for how long investment horizon is it recommended?

The fund is recommended for longer-term financial goals and portfolio building for those who expect their return on investment to be driven by the performance of climate change industries (renewable green energy, sustainable water, food and waste management) over the time horizon indicated.

The recommended minimum investment horizon is 5 years.

Benchmark

- 70% MSCI ACWI IMI SDG 7 Affordable and Clean Energy Select

- 25% MSCI EMU Climate Change ESG Select NETR EUR

- 5% RMAX

Objective of the fund

The fund aims to select stocks that could be potential winners in the global adaptation process to climate change. OTP Fund Management Ltd. seeks to optimise expected returns and risks over the long term, and the fund is recommended for those who wish to invest for the long term.

Investment policy

Pollution and global warming are increasing the role of industries and companies that focus on sustainable development. The fund’s assets are mainly made up of shares in listed companies in sectors related to climate protection and sustainable development – renewable green energy, sustainable water, food and waste management.

The fund’s active investment policy provides a high-risk investment opportunity in equities of developed and emerging market companies that could be winners from policies, legislation and economic policy changes that seek to reduce the impact of climate change.

Portfolio managers

Awards and recognition

Over the years, the fund has been awarded the Privátbankár.hu Klasszis Award several times: Best Global Equity Fund.

Where can you buy investment units?

At OTP Bank

The investment units of the fund are available online or in the branches.

Via OTP InternetBank or OTP MobilBank

You can also buy investment units online if you have internet bank access and a securities account with OTP Bank.

Buy onlineIn person at an OTP Bank branch

Find your nearest securities trading bank branch and make an appointment!

Book on appointmentInformation on distribution

There is no limit on the value of an investment in the fund. You can buy investment units in any amount and increase or decrease the value of your investment as you wish. Moreover, the nominal value of the fund is HUF 1 or EUR 1, so you can easily, flexibly and accurately adjust the value of your investment to the amount you want to invest.

What distribution fees should I expect?Please consult the various distributors’ announcements for more detailed information on the subscription and redemption commission charged by the distributors in relation to the distribution of the fund units and on any other fees and commissions arising in relation to the investment fund (securities account management fee, the transfer fee of fund units, etc.).

How does settlement take place?This is an open-ended fund, so its units can be bought and redeemed on any trading day at the net asset value (price) per unit on that day. For the distribution of the units of the fund T+3 days settlement will be used, i.e. the settlement and the crediting of the units will take place on the 3rd trading day (T+3 days) following the order at the price calculated on the basis of the closing price at the end of the trading day (T+1 day) following the order.

Past performances

Net returns based on net asset value, expressed as a percentage, annualized returns for periods longer than 1 year (calculated

using the compound interest method, based on a 365-day year). Values before deduction of taxes, contributions and distribution

costs. Source of historical yield data: Bloomberg (reference index) and OTP Fund Management (funds).

Risk indicators

In this section, you will find past performances of the main risk indicators for the fund. The volatility, tracking erreor,

alfa, maximum drawdown are expressed in percentage.

Sustainability-related disclosures

In this section you can read more about the sustainability information related to the fund.

Summary

At OTP Climate Change Equity Fund, we integrate sustainability considerations into investment decision-making in two steps. As a first step, we filter the securities in the benchmark index and develop a shortlist of investment targets of interest to the Fund. From the broader investment universe, we select companies that we believe can benefit from political, economic and social responses to climate change through products or services that are considered to be useful for climate protection.

The shortlist may include securities that are not part of the benchmark index but are seen to contribute to sustainable development.The shortlist does not include shares of companies if more than 5% of their turnover comes from arms or tobacco sales. We also do not invest in companies that derive more than 50% of their revenue from coal, natural gas or oil production. OTP Fund Management Ltd. uses a factor model to construct the final portfolio from the shortlisted stocks. The environmental (E), social (S) and corporate governance (G) performance of companies is integrated as a factor in the portfolio design using the Advisor’s ESG Pillar Score.

At least 50% of the final portfolio must be made up of equities of companies that have a good – “sustainable” – ESG rating besides contributing, in our opinion, to the conservation of planet Earth. A good sustainable rating is defined as an MSCI rating between AAA and BBB for developed market equities and between AAA and BB for emerging market equities.

Lack of a sustainable investment objective

The Fund does not currently have a commitment to invest in sustainable economic activities, therefore the Fund does not take into account the sustainability characteristics of potential target companies in addition to the ESG rating when making investment decisions, and does not invest in environmentally or socially sustainable economic activities as part of its Investment Policy.

Environmental or social characteristics of the financial product

The primary objective of the Fund is to mitigate and facilitate the adaptation to climate change. The Fund aims to achieve its objective, in accordance with Article 16 of the Taxonomy Regulation, by investing in companies whose activities, mainly through the products they produce, contribute directly to the activities of other companies that make a significant contribution to the fight against climate change.

Investment strategy

The Fund aims to select stocks that could be potential winners in the global adaptation process to climate change. OTP Fund Management Ltd. seeks to optimise expected returns and risks over the long term, and the Fund is recommended for those who wish to invest for the long term. The Fund’s portfolio is primarily composed of equities of developed and emerging market companies benefiting from investment opportunities arising from global climate change.

Investment rate

AAA–BBB MSCI ESG Ratings Advanced Market Equities + AAA–BB MSCI ESG Ratings Advanced Market Equities as a percentage of equity investment.

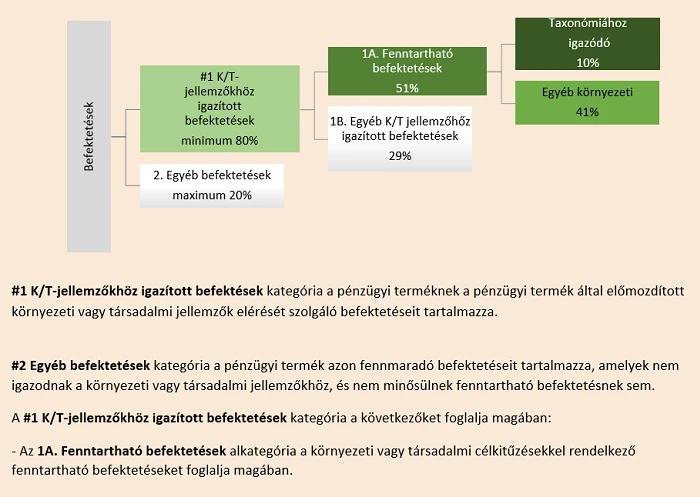

The two diagrams below show in green the minimum percentage of investments that are in line with the EU taxonomy. As there is no appropriate methodology for determining the alignment of government securities* to taxonomy, the first diagram shows the taxonomy of the financial product in relation to all investments, including government securities. The second diagram shows the taxonomy of the financial product in relation to investments other than government securities.

*For the purposes of these diagrams, “government securities” include all government securities exposures.

Az alsó két diagram zöld színnel mutatja be az uniós taxonómiához igazidó befektetések minimális százalékos részarányát. Mivel az állampapírok* taxonómiához való igazodásának meghatározására nem létezik megfelelő módszertan, az első diagram a pénzügyi termék összes befektetéséhez viszonyítva mutatja be a taxonómiához való igazodást, beleértve az állampapírokat is, míg a második diagram csak a pénzügyi termék állampapíroktól eltérő befektetéseihez viszonyítva mutatja be a taxonómiához való igazodást.

Monitoring environmental and social characteristics

The Fund is rated SFDR 8 and therefore has no sustainability objective. It aims to promote its environmental objectives not directly through the sustainability features of the target companies' operations, but through the users of the products produced by the target companies. On this basis, it examines the taxonomy of the target companies’ sales as a sustainability indicator, and does not apply any other indicators specifically related to climate change or CO2 emissions. At the same time, it takes into account the environmental (E), social (S) and corporate governance (G) performance of the companies when selecting the target companies, using the ESG Advisor's indicators provided by an external rating system (Environmental, Social, Government Pillar Score). The Fund Management Ltd. will also take into account the development of the PAI indicators in its investments as described in the Due Diligence section. In addition to the product-level PAI compliance described therein, Fund Management Ltd. also monitors the contribution of the target companies to environmental objectives through their own operations, in addition to the usefulness of their products in the fight against climate change, by measuring the following PAI indicators:

- GHG emissions

- Carbon footprint;

- Exposure to companies active in the fossil fuel sector;

- Share of non-renewable energy consumption and production.

Methodology

At least 50% of the final portfolio must be made up of equities of companies that have a good – “sustainable” – ESG rating besides contributing, in our opinion, to the conservation of planet Earth. A good sustainable rating is defined as an MSCI rating between AAA and BBB for developed market equities and between AAA and BB for emerging market equities.

In creating and re-weighting the portfolio, the maintenance of sustainability risks at the appropriate level – as expected by the Fund Manager – should be considered. If the sustainability risk exposure exceeds the level expected from the portfolio, measures must be taken to reduce the sustainability risk to an acceptable level.

It is primarily the portfolio manager managing the ESG fund who is required to monitor whether the consolidated average sustainability risk of the instruments contained in their portfolio is consistent with the level expected from the portfolio. Moreover, before investing in a new instrument, the portfolio manager should examine the ESG rating of the specific instrument and the extent to which it will modify the ESG rating of the portfolio.

Secondly, the risk management unit prepares a report on a weekly basis on changes in the funds’ sustainability risk, which is sent to the portfolio managers managing the ESG fund and to the CEO and Deputy CEO of the Fund Manager. Members of the Board of Directors are presented an ESG-related summary in the context of the quarterly Risk Management Report.

If the sustainability risk level of a specific portfolio exceeds the level targeted by the portfolio, the relevant portfolio manager is required to take appropriate measures to reduce the sustainability risks, which may consist of the following:

- Re-weighting the portfolio;

- Investing in instruments with a higher ESG rating

After the portfolio manager is informed of the target limit breach by the risk management unit, they have 90 calendar days to restore the asset composition of the fund to return to the range of the targeted levels.

Data sources and data processing

The Fund Manager uses ESG ratings and scores provided by an external data provider (MSCI).

The data provider employs more than a hundred analysts worldwide, who collect a broad range of sectorial and company-specific

data in relation to E, S and G. The data provider also scores these separately; moreover, it consolidates and categorises

the scores into a uniform ESG rating. It defines the E and S indexes of individual companies relative to the industrial average,

and G for the specific company. The data provider updates its ratings on a regular basis

Methodological and data limitations

Given that the Fund contributes to the environmental objectives through the users of the products produced by the target companies

rather than directly through their emissions, no specific indicator linked to the objectives is applied.

At the same time, the environmental (E), social (S) and governance (G) performance of companies is assessed and taken into

account in the portfolio design using the ESG Advisor’s Environmental, Social, Government Pillar Score.

Due diligence

In addition to sustainability risk, another important aspect is principal adverse sustainability impact (Principal Adverse Impact – PAI). Adverse sustainability impact is defined as a negative outcome of the underlying investment in a product on sustainability factors, i.e. the investments in the Fund may have a direct or indirect adverse impact on sustainability factors (such as air quality, biodiversity, drinking water, human rights, working conditions, etc.).

The Fund Manager shall consider the adverse impact of its investment decisions on sustainability factors in respect of this Fund.

This is done by applying a so-called exclusion and restriction list, whereby the Fund Manager sets investment limits for tobacco, alcohol, gambling, coal mining, arms manufacturing and authoritarian regimes. In addition to, and partly overlapping with, the exclusion lists, the Fund Manager monitors the following PAIs when making investment decisions:

- PAI 5 – Exposure to companies active in the fossil fuel sector

- PAI 14 – Exposure to controversial weapons (anti-personnel mines, cluster bombs, chemical weapons and biological weapons)

- PAI 16 – Investee countries subject to social violations

In addition to the above, OTP Fund Management Ltd. shall provide information on the development of all the mandatory indicators in accordance with the relevant legal requirements, and on the development of the following indicators in addition to the mandatory indicators in the periodic report:

- Additional indicators related to climate and the environment: Water, waste and pollutant emissions

- Additional indicators related to social and labour rights, respect for human rights, anti-corruption and anti-bribery: Social and employee matters

The manner in which sustainability impacts are considered and the indicators used are set out in OTP Fund Management Ltd.’s Sustainability Risk Management Policy, details of which are available here (Statement on the adverse impact of investments on sustainability factors and the due diligence and engagement policy applied).

Information on the trends in adverse sustainability impacts is available on OTP Fund Management Ltd.’s website together with the Fund’s Annual Report.

Commitment policies

OTP Fund Management Ltd. will give special consideration to sustainability risks when deciding whether to vote on the proposals of the Companies at the General Meetings, in particular for those Companies whose shares are also held in investment funds managed by OTP Fund Management Ltd. in accordance with Articles 8 and 9 of the SFDR.

OTP Fund Management Ltd., as an engaged investor, seeks to engage in an active dialogue with the management of the Companies concerned as part of the sustainability process, at least for Article 9 SFDR compliant investment funds, in the context of its core and key shareholder engagement. This will help identify weaknesses in the management of environmental, social and governance aspects, which will provide a common solution to improve these areas and thus improve the long-term success of the investment. OTP Fund Management Ltd. may exclude from the investment universe companies that consistently refuse to engage in dialogue.

Designated benchmark

No.