OTP Omega Developed Market Equity Fund of Funds

Open-ended, public, developed, ESG, equity fund

I’d like to investCurrent price and net asset value

Past yields

Past performances don’t guarantee future performances. In addition to examining the retrospective yields, it is also essential to observe the recommended minimum investment horizon.

Infó

Total net asset value of the different investment fund series (data calculated using the compound interest method with a fractional exponent on a 365-day annual basis). Values before deduction of taxes, contributions and distribution costs. The sources of past performances: Bloomberg (benchmark) and OTP Alapkezelő (funds).

Buy your investment unit in OTP InternetBank!

You can also buy your investment unit online if you have internet bank access and a securities account at OTP Bank.

DetailsPresentation of the fund

This is an ESG fund that invests in the world’s most developed equity markets and takes environmental and social sustainability into account.

For whom and for how long investment horizon is it recommended?

The fund is recommended for longer-term financial goals and portfolio building for those who expect their investment returns to be driven by the rise in developed equity markets over the indicated time horizon. It is also recommended for those who want to benefit from the performance of hundreds of developed market companies for a single buy order fee.

The recommended minimum investment horizon is 5 years.

Benchmark

- 95% MSCI World ESG Focus

- 5% RMAX

Objective of the fund

The fund aims to provide a flexible investment vehicle, accessible at any time, for funds available in the long-term, benefiting from the performance of the global developed equity markets.

Investment policy

The fund offers investors broad developed market exposure through its international equity fund units. The stocks are primarily from North American markets with a secondary focus on Western and Far Eastern European markets. Investment unit holders could benefit from the performance of thousands of individual shares in a simple and cost-effective way by buying a single unit, thanks to the fund of funds structure and high equity exposure. The remaining 5% of the portfolio, on average, is invested in short-term Hungarian government bonds. The fund’s assets are mainly developed market equity funds, individual equities, index-tracking derivatives, ETFs.

Portfolio managers

Awards and recognition

Where can you buy investment units?

At OTP Bank

The investment units of the fund are available online or in the branches.

Via OTP InternetBank or OTP MobilBank

You can also buy investment units online if you have internet bank access and a securities account with OTP Bank.

Buy onlineIn person at an OTP Bank branch

Find your nearest securities trading bank branch and make an appointment!

Book on appointmentInformation on distribution

There is no limit on the value of an investment in the fund. You can buy investment units in any amount and increase or decrease the value of your investment as you wish. Moreover, the nominal value of the fund is HUF 1 or EUR 1, so you can easily, flexibly and accurately adjust the value of your investment to the amount you want to invest.

What distribution fees should I expect?Please consult the various distributors’ announcements for more detailed information on the subscription and redemption commission charged by the distributors in relation to the distribution of the fund units and on any other fees and commissions arising in relation to the investment fund (securities account management fee, the transfer fee of fund units, etc.).

How does settlement take place?This is an open-ended fund, so its units can be bought and redeemed on any trading day at the net asset value (price) per unit on that day. For the distribution of the units of the fund T+3 days settlement will be used, i.e. the settlement and the crediting of the units will take place on the 3rd trading day (T+3 days) following the order at the price calculated on the basis of the closing price at the end of the trading day (T+1 day) following the order.

Fund performance

This section provides information on the Fund's past performance.

Infó

The Fund's past performance is no guarantee of future returns. When making an investment decision, it is essential to consider not only historical returns but also the recommended minimum investment period.

Performance for closed calendar years

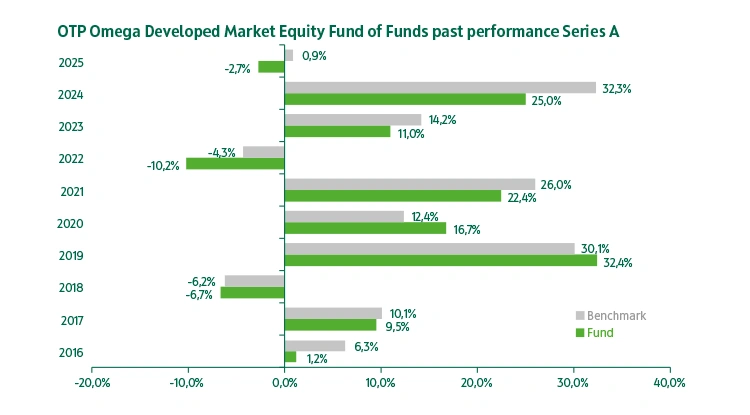

Past performance of Series A investment unitsThe chart shows the Fund's performance since inception, but for a maximum of the last 10 years, as a percentage of losses or gains relative to the benchmark. Past performance is not a reliable indicator of future performance. Markets may perform very differently in the future. The chart can help you assess how the Fund has been managed in the past and compare it to its benchmark.

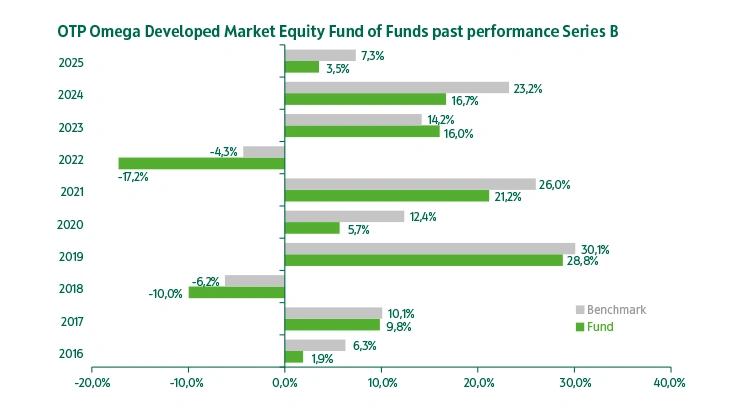

Past performance of Series B investment unitsThe chart shows the Fund's performance since inception, but for a maximum of the last 10 years, as a percentage of losses or gains relative to the benchmark. Past performance is not a reliable indicator of future performance. Markets may perform very differently in the future. The chart can help you assess how the Fund has been managed in the past and compare it to its benchmark.

Past performances

Net returns based on net asset value, expressed as a percentage, annualized returns for periods longer than 1 year (calculated

using the compound interest method, based on a 365-day year). Values before deduction of taxes, contributions and distribution

costs. Source of historical yield data: Bloomberg (reference index) and OTP Fund Management (funds).

Risk indicators

In this section, you will find past performances of the main risk indicators for the fund. The volatility, tracking error,

alfa, maximum drawdown are expressed in percentage.

Sustainability-related disclosures

In this section you can read more about the sustainability information related to the fund.

Summary

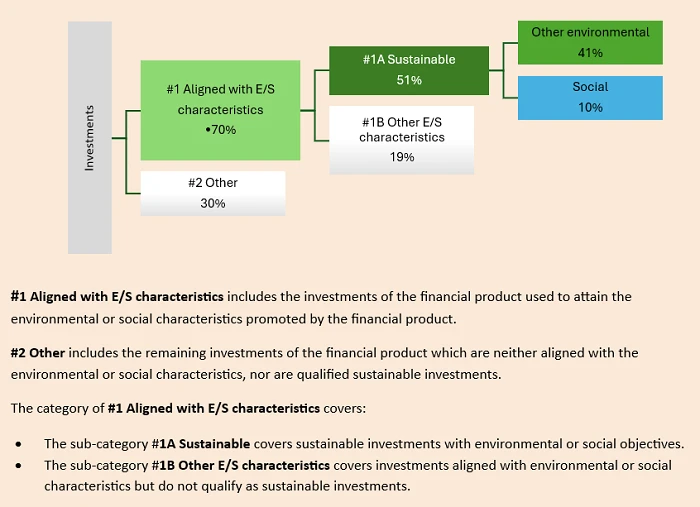

The objective of the OTP Omega Developed Market Equity Fund of Funds is to enable its investors to benefit from the performance of developed markets with the help of actively and passively managed equity funds, ETFs, and to a lesser extent, direct equity investments, while promotes environmental or social characteristics as well.

The fund management company aims to have at least 70% of its assets invested in Article 8. of the EU SFDR Regulation on sustainability disclosures (which promotes environmental or social characteristics) or Article 9. funds (fund's objective is to invest sustainably). From sustainability perspective, it should also be highlighted that the fund seeks to achieve a weighting of at least 51% in so-called sustainable investments of the portfolio.

Moreover another important characteristic of the fund that at least 50% of the final portfolio must contain shares of companies which have good and sustainable ESG rating. An expected minimum sustainable rating means an MSCI rating between AAA-BBB for developed market shares and a rating between AAA-BB for emerging market shares.

Lack of a sustainable investment objective

This financial product promotes environmental or social characteristics, but does not have any sustainable investment objectives. At the same time, the Fund invests in environmentally or socially sustainable economic activities, during which the Fund Manager monitors and seeks to avoid adverse impacts that it considers key, in addition to sustainability criteria.

Avoiding adverse impacts relating to sustainable investments occurs at two levels.

First level: The ESG data provider (MSCI ESG Research) screens investments based on Principal Adverse Impact (PAI) indicators that measure adverse impacts. In this process, only those investments that meet the DNSH assessment for avoiding significant harm, in addition to other criteria required by law, can be considered sustainable.

Second level: In addition to the above, the Fund Manager shall endeavor to avoid significant harm in accordance with the provisions of the PAI statement applicable to the Fund Manager at the organizational level, taking into account the additional indicators specified therein and applying exclusion lists.

The minimum safeguards under Article 18 of the Taxonomy Regulation (as set out in the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights) are applied in the ESG provider's screening of credit institutions that accept deposits in the form of shares or corporate bonds, as well as of deposit-taking credit institutions and OTC derivative counterparties. Where this information is available, it is validated in the screening process.

Although we expect all target companies to adhere to good corporate governance practices, we assess compliance not only against the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights, but also using the Governance Pillar score calculated and published by the ESG provider. In the latter area, a BB rating or higher is required.

Environmental or social characteristics of the financial product

In accordance with Article 8 of the SFDR, the fund aims to promote environmental and social characteristics. To this end, it invests in other funds which typically contribute to the advancement of SDG 7 (affordable and clean energy) and SDG 13 (climate action) of the UN's 2030 Sustainable Development Goals. The social characteristics most closely linked to the fund's investments are gender equality (SDG 5) and reducing inequality (SDG 10).

Investment strategy

The fund enables its investors to participate in the returns of developed foreign stock markets by investing in actively and passively managed equity funds, while promoting environmental and social characteristics.

This is primarily ensured by the following strategic elements:

- The fund management company aims to have at least 70% of its assets invested in Article 8. of the EU SFDR Regulation on sustainability disclosures (which promotes environmental or social characteristics) or Article 9. funds (fund's objective is to invest sustainably).

- When selecting funds, the Fund Manager primarily uses alignment indicators for SDG 7 (clean energy), SDG 13 (climate action) and SDG 5 (gender equality) and SDG 10 (reduced inequalities) in order to promote the aforementioned environmental and social characteristics.

- The Fund Manager also seeks to achieve a weighting of at least 51% in sustainable investments.

Good corporate governance practices are assessed using the Governance Pillar score, which is calculated and published by the ESG service provider. This score measures various factors, including the performance of companies in terms of governance structures, employee relations, staff remuneration, ethical standards, accounting practices and tax transparency. This enables a comprehensive evaluation of corporate governance. A BB or higher rating is required for this score.

Investment rate

The Fund Manager aims to ensure that at least 70% of the fund is invested in assets that align with environmental or social characteristics. This is ensured by selecting funds that promote environmental or social characteristics in accordance with Article 8 of the EU SFDR Regulation, or funds that aim to invest sustainably in accordance with Article 9. Furthermore, at least 51% of the fund's assets are invested in sustainable investments, divided between investments with environmental and social objectives in a ratio of 41:10. The remaining 19% of the 70% is invested in assets that align with environmental or social characteristics, but which do not qualify as sustainable investments.

The fund does not have a minimum percentage allocation for investments that are aligned with the EU taxonomy.

Monitoring environmental and social characteristics

In accordance with Article 8 of the SFDR, the fund aims to promote environmental and social characteristics. To this end, it invests in other funds which typically contribute to the advancement of SDG 7 (affordable and clean energy) and SDG 13 (climate action) of the UN's 2030 Sustainable Development Goals. The social characteristics most closely linked to the fund's investments are gender equality (SDG 5) and reducing inequality (SDG 10).

To monitor these characteristics, the Fund Manager uses indicators from its chosen ESG service provider (MSCI ESG Research). These indicators measure the compliance of products and services produced by target companies (e.g. positive contribution: alternative energy; negative: fossil fuel-based energy production and related products) and the alignment of operations with targets.

Based on this, the Fund Manager regularly reviews the development of the aforementioned SDG alignment indicators throughout the fund's entire life cycle and reports on this regularly in the annual report.

While these are not specific sustainability indicators, investors may still find it useful to know that the Fund Manager also monitors the average ESG rating of the underlying funds (i.e. the proportion of investments in the underlying funds with an ESG rating of A, AA, AAA, etc.) and whether the underlying funds intend to promote environmental or social characteristics (i.e. SFDR Article 8 funds) or aim for sustainable investment (i.e. SFDR Article 9 funds). These indicators can also be tracked in the annual report.

The ESG service provider's quality assurance system serves as an external control mechanism for sustainability indicators.

Methodology

To comply with the sustainable investment limit of 51%, SFDR 9 funds are calculated based on their portfolio weighting. For SFDR 8 funds, the sustainability ratio is determined using a look-through analysis of the underlying fund, as provided by MSCI ESG Research. In this analysis, the SFDR 8 fund is included in the weighting to the extent of its sustainable investment ratio.

The ESG scores and ratings of the underlying funds are provided by MSCI ESG Research. The ESG score assigned to a fund is determined by averaging the ESG scores of its underlying funds. Assets without an ESG rating are excluded when determining the weighted score.

MSCI ESG Research also provides data on the extent to which the target companies' products and services of the underlying funds are aligned with the SDGs, based on a look-through analysis of the underlying fund. This analysis determines the proportion of the target companies' revenue and overall operations that are aligned with the SDGs.

Data sources and data processing

Currently, the Fund Manager relies primarily on data collected by MSCI ESG Research, as well as its methodology for assessing sustainable investments and the degree of alignment with SDG goals, PAIs, and sustainability indicators in general. The Fund Manager does not currently process or adjust data, nor does it collect data independently.

There is no data quality control policy in place and no regular data quality checks are performed. The Fund Manager does not use data estimated in-house.

Methodological and data limitations

In line with its fund-of-funds structure, the fund invests in other actively and passively managed funds. The analysis provider (MSCI) publishes Environmental, Social and Governance (ESG) ratings for some of the funds, but not all. This depends partly on the business considerations of the ESG adviser and partly on those of the individual fund managers.

The Fund Manager addresses this by monitoring the ESG ratings of the individual funds, but does not set a target level, focusing instead on SFDR compliance and the proportion of sustainable investments.

The Fund Manager uses analysis of SDG compliance for the underlying funds to measure achievement of sustainability goals and determine the degree to which each underlying fund aligns with these goals. However, at the time of writing, information on environmental or social characteristics and/or main adverse impacts was still limited for certain assets, particularly non-specific target companies. Therefore, the external data provider determined these using other publicly available, similar data.

Despite the aforementioned limitations on data availability and quality, the Fund Manager believes that the environmental and social characteristics promoted by the fund can be monitored and that its ESG objectives, as set out in the management regulations, can be achieved.

Due diligence

Due to the fund of funds structure, the Fund Manager conducts due diligence on the underlying assets of the fund using a look-through approach.

For investments aligned with environmental and/or social characteristics, compliance with good corporate governance criteria is primarily monitored using the Governance Pillar score, which is calculated and published by the ESG service provider, MSCI ESG Research. In the latter case, a BB or higher rating is required.

To avoid adverse impacts, the screening approach is as follows:

An adverse sustainability impact is defined as a negative result of the investment underlying the product in terms of sustainability factors. This means that the investments in the fund may directly or indirectly impact sustainability factors such as air quality, biodiversity, drinking water resources, human rights and working conditions.

The Fund Manager considers the impact of its investment decisions on sustainability factors in respect of this Fund.

This is done by applying a so-called exclusion and restriction list, whereby the Fund Manager sets investment limits for tobacco, alcohol, gambling, coal mining, arms manufacturing and authoritarian regimes. In addition to, and partly overlapping with, the exclusion lists, the Fund Manager monitors the following PAIs when making investment decisions:

- PAI 14 – Exposure to controversial weapons (anti-personnel mines, cluster bombs, chemical weapons and biological weapons)

- PAI 16 – Investee countries subject to social violations

In addition to the above, OTP Fund Management Ltd. shall provide information on the development of all the mandatory indicators in accordance with the relevant legal requirements, and on the development of the following indicators in addition to the mandatory indicators in the periodic report:

- Additional indicators related to climate and the environment: Water, waste and pollutant emissions

- Additional indicators related to social and labour rights, respect for human rights, anti-corruption and anti-bribery: Social and employee matters

The manner in which sustainability impacts are considered and the indicators used are set out in OTP Fund Management Ltd.’s Sustainability Risk Management Policy, details of which are available here (Statement on the adverse impact of investments on sustainability factors and the due diligence and engagement policy applied).

Information on the trends in adverse sustainability impacts is available on OTP Fund Management Ltd.’s website together with the Fund’s Annual Report.

Internal control over due diligence is provided by the Fund Manager's internal monitoring and analysis, while external control is provided by the quality assurance system of the ESG service provider.

Engagement policies

Due to the nature of the fund-of-funds structure, the fund does not have a uniform engagement policy.

Designated benchmark

No.

Past performance of Series B investment units

Past performance of Series B investment units